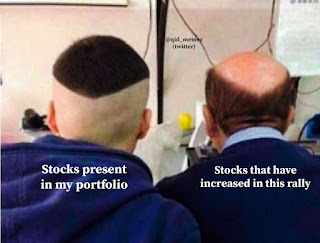

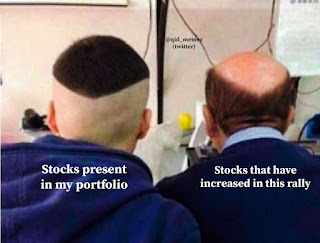

It is a crib of The retailed reader that whenever they buy the stock goes down and whenever they sell the stock moves up. This mean clearly depicts the state of retail traders who are invested in the stock market.

Retail traders portfolio does not move positively.

There are many reasons for this, but the main reason is that retail traders portfolio does not have enough liquidity or trading volume. This means that it will not provide enough opportunities to earn profits or build up a large sum of money. In addition, retail traders who want to invest in individual stocks need to spend a lot of time choosing which stocks they want to buy, which can take up a lot of time and effort. Now the question arises that why it happens with the retail traders that which of the stock they buy eventually it goes down and does not give them any positive Returns.

Retail traders portfolios are usually a bad idea for risk management.

Let me explain.

A retail portfolio is made up of a collection of stocks that you want to invest in. You don't want to invest in the whole market, or even most of it—you just want to invest in one or two companies. You can also have multiple positions in each company, but this is less common. The main idea behind a retail trader's portfolio is that it's simple and easy to understand, and that it doesn't take much time or effort to manage.

The problem with this approach is that it doesn't allow for diversification—that is, spreading your money out over many different companies so that if something happens to one company (like its stock price falling), you won't lose all your money at once.

You need more than one position in each company if you're going to be able to protect yourself from downside risk and still make money on upside potential. If you had only one position per company and then lost all.

The retail trader's portfolio does not move positively because it is a simple portfolio of stocks. This means that the portfolio only holds a few different stocks, and it's easy to keep track of those stocks at once. The portfolio also has a low number of stocks in it, which makes it difficult to add new stocks without making the overall portfolio more complex.

The retail trader's portfolio is also not very liquid. This means that if you want to sell off some stock holdings in your portfolio, you have to sell them all at once—which can be time-consuming and potentially costly.

Finally, the retail trader's portfolio has low turnover rates: there aren't many trades happening on a regular basis because most investors don't buy and sell securities very often or at all.

On analysis, it has been found that generally stock traders get into those stocks which are dead stocks may be penny stocks. As a thumb rule remember that you have to always invest in Nifty 50 or Max Nifty 100 stocks.

Nifty 100 means that all those stocks which are in compensating the Nifty 100 index will only try to get your investment in those stocks. Keep yourself away from Penny Stocks because the chances of their doubling tripling are remote and the chances of your losing the whole capital are on the higher side. These penny stocks are fueled by the rally created on social media by rumour mongering. They create an element of FOMO among clients through social media buzz.

The retail traders portfolio is a great way to start your investment career.

But it's not just an investment portfolio: it's an opportunity to learn and grow, and it can help you see the world in new ways. You'll get a chance to see how different types of investments work together, and you'll learn how to manage risk and get the most out of your portfolio.

The retail traders portfolio is also great for people who want to make money fast. The reason? It's very easy to make money with this type of portfolio—as long as you're willing to accept some risk. That's because the main component of this portfolio is stocks, which tend to move up or down over time due to changes in demand for their services or products.