BankNifty Spot View For 04/01/2023

Cmp: 43425.25

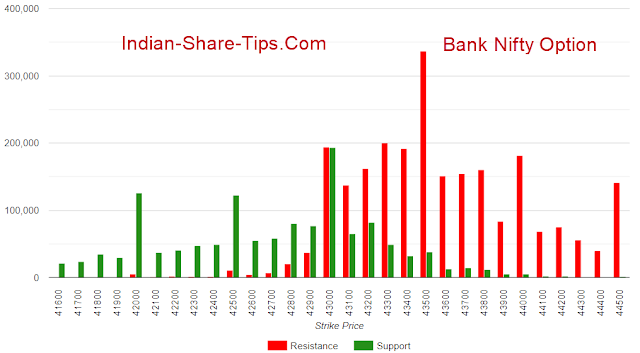

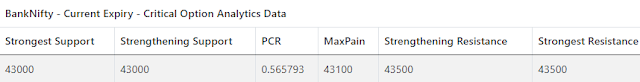

Support & Downside Range: 43232—43155—43079--43038

Resistance & Upside Range: 43509—43852--44150

Short-Term Trend Reversal Level: --

Bank Nifty Option Chain Tips

Trading View: In today's intraday trading session key level to watch is the 43232 spot level after opening if bulls manage to hold these levels then we may immediately move upside towards minimum 43509 and max 43852 as intraday upside levels whereas if 43232 gets broken then move gets range bound to sideways in the first half and we may trade between 43232 to 43038 spot zone, here 43038 is a very crucial level to watch if it breaks and we closes below it then we may see more selling pressure to starts in coming days in bank index so understand the importance of 43038 spot levels here.

There are TWO types of traders. Those who understand what a TRUE TREND is... and those who don’t.

Most traders fall victim to conventional wisdom that suggests that a trend is ANYTHING that’s above or below a moving average.

If only it were so simple.

Unfortunately — a market is ALWAYS above or below a moving average.

That tells you almost nothing.

On the other hand, when you “crack the code” on spotting a true trend — which is what we learned when working at a big firm trading billions of dollars...

... you can be accurate as high as 90% of the time and we achieve this kind of accuracy courtesy

Bank Nifty Option Chain Tips and you could be part of our team earning profit on a daily basis.

If you are buying puts than hedge with sell puts and if you buying calls then sell calls to hedge it and our advise is to remain hedged till budget announcement.

You can trade month end options and one can avoid weekly options because trading in month options you will get a chance to exit your trades even if your direction is wrong.

For those who feel that after budget we are going to hit ATH can create a postion in March month end calls and for those who think after budget mkt will sink can creat position in March month end put options.

India Composite PMI Climbs to Near 11-Year High

The S&P Global India Composite PMI jumped to 59.4 in December 2022 from 56.7 a month earlier. This was the highest reading since January 2012, with manufacturers and service providers recording faster expansions in output. New orders grew sharply and at the fastest pace since August, boosted by quicker expansions at goods producers and services firms. Also, the rate of job creation remained above its long-run average, as capacity pressures remained mild. In terms of prices, input cost inflation was at a two-month high, above the average; while output charge inflation ticked higher, with a stronger increase in the manufacturing industry more than offseting a slowdown among service providers.