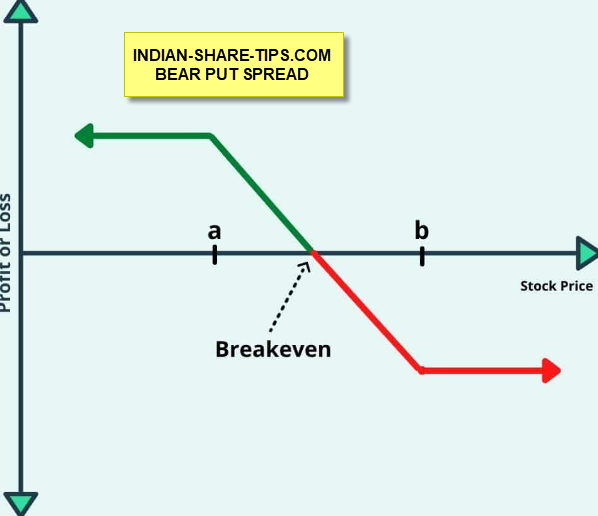

A bear put spread is an options trading strategy that involves selling put options with a lower strike price and buying the same number of put options of the same underlying security and expiration date at a higher strike price.

The strategy is created by purchasing one put option while simultaneously writing another put option with the same expiration date, but it has a lower strike price. The maximum potential loss for the bull spread options strategy occurs when the underlying stock's market price moves higher than the higher strike price or lower than the lower strike price.

When volatility is high and you are moderately bearish and you do not want to go naked and this is the right time to go for a bear put spread.

A bear put spread consists of one long put with a higher strike price and one short put with a lower strike price. Both puts have the same underlying stock and the same expiration date. A bear put spread is established for a net debit (or net cost) and profits as the underlying stock declines in price.

Bear Put Spread Strategy

In Nifty you can take a stop loss of 15 points with a target of 30 points while using a bear put spread. The below example is only for illustration purposes. In periods of higher volatility, you can keep a stop loss of 10 and a profit of 20 giving your risk-reward ratio of 1:2

For eg, if you are moderately bearish, you can Buy PE 18300 and Sell PE 18200. By buying you pay the premium and by selling you get a premium.

A bear put spread is an options trading strategy that involves buying put options with a lower strike price and selling the same number of put options of the same underlying security and expiration date at a higher strike price.

In this way, you're spreading out your risk by taking on less capital upfront but still making money if your stock rallies ahead of its expiration date.

The strategy is created by purchasing one put option while simultaneously writing another put option with the same expiration date, but it has a lower strike price.

Once you've established that you want to participate in a bear market and know when it will begin, then we can talk about how to profit from it. This is where our spreads come in.

The maximum potential loss for the bull spread options strategy occurs when the underlying stock's market price moves higher than the higher strike price or lower than the lower strike price. If this occurs, then your option may expire worthlessly and you will lose all of your investment in this trade.

In contrast, if your stock remains steady at its current level throughout its life span, meaning it does not move beyond either side of a spread's strike prices (i.e., you don't make money), then there is no risk involved with holding those positions until expiration day arrives.

A bear put spread involves both buying and selling puts. The first option is at a lower strike price than the second. Both options have the same expiration date, so they’ll expire at different times in the future (one late and one early).

The difference between this strategy and a bull call spread is that you’re trying to sell your two options in order to pocket some cash, while still keeping your delta neutral—meaning that your overall position doesn't change much from day to day as long as no trades are executed).

A bear put spread is an options strategy that involves buying a lower-strike put with an expiration date and selling the same number of options at a higher strike price. A bull spread involves both buying and selling calls.

You can make fantastic money using our Bank Nifty tips or bank nifty option tips for tomorrow as we trade less but trade accurately.

If you love our market view and Index levels - do drop share the word. It Motivates us to do more!

To sum it we can state as follows:

A bear put spread is a options trading strategy that involves buying a put option at a higher strike price and simultaneously selling a put option at a lower strike price. The goal of this strategy is to profit from a moderate decrease in the price of the underlying asset.

When implementing a bear put spread, the trader will typically buy a put option with a strike price that is at-the-money or slightly out-of-the-money, and then sell a put option with a lower strike price. The difference in the strike prices is known as the spread.

This strategy is best used when the trader expects the underlying asset to experience a moderate price decrease, but does not expect the price to fall significantly below the strike price of the put option sold.

The maximum profit for this strategy is the difference between the two strike prices, less the premium received for the short put option. The maximum loss is limited to the difference between the two strike prices, minus the premium received for the short put option.

It's important to note that options trading is complex and it's not suitable for beginners. It's important to have a good understanding of the underlying asset, market conditions, and the mechanics of options trading, before implementing this strategy. Additionally, it is important to have a risk management plan in place to limit losses. As with any investment, it's important to be aware of the risks and to not invest more than you can afford to lose.

Make money using our bank nifty option tips on a daily basis.