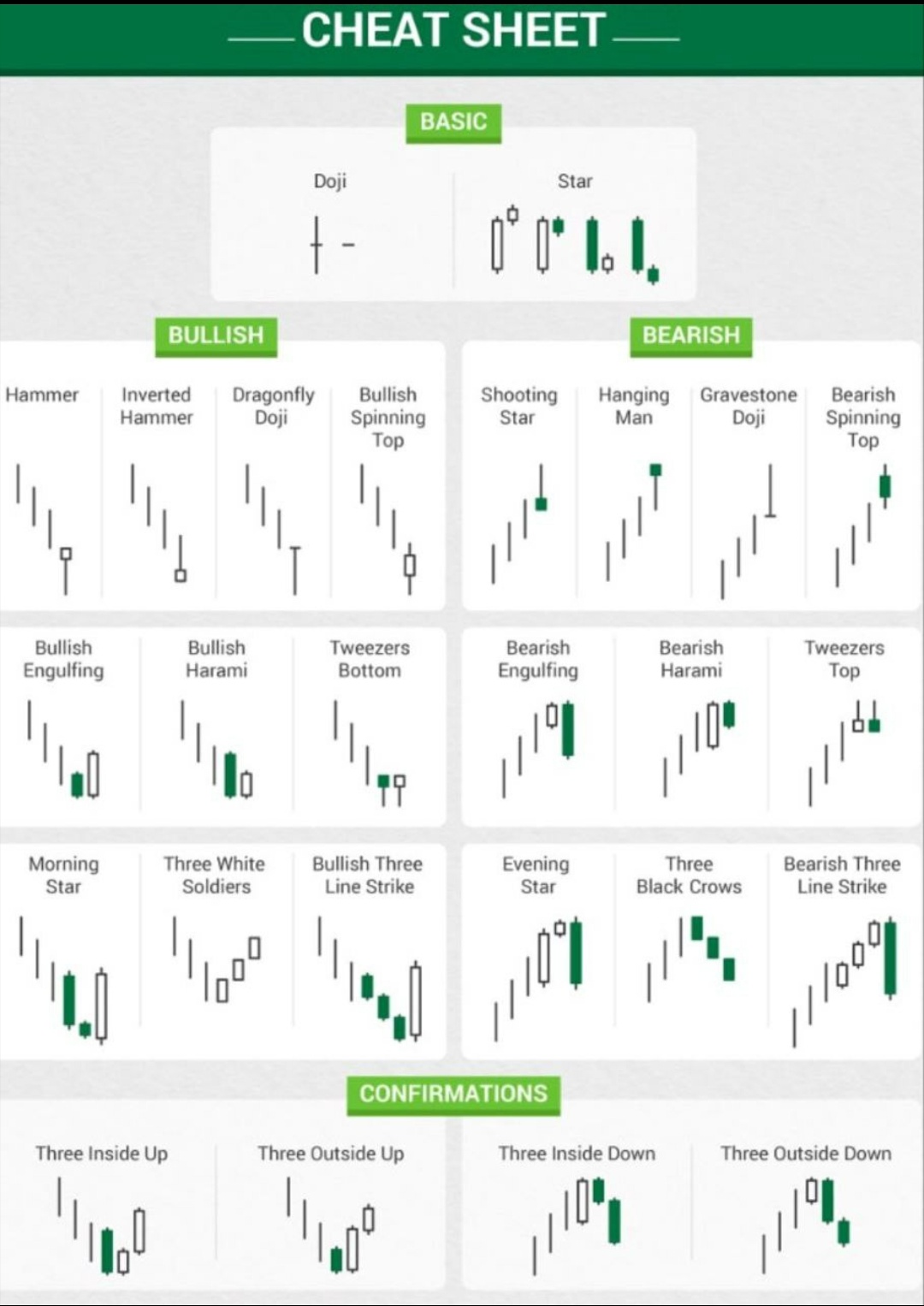

Candlestick Patterns

Introduction

Candlestick patterns are one of the most common ways to trade markets. They help you identify trends that may be on the horizon and give you an advantage over your competition. Candlestick patterns can also be used as indicators for when to buy or sell a security, as well as tips for how to manage your portfolio if you want to become more successful in trading stocks and other financial assets.

The Opening White Marubozu

The opening white marubozu is a bullish candlestick pattern. It shows that the price opened lower than it closed the previous day.

It is a continuation pattern, which means that after breaking out of an old high or low range, prices will continue to move higher in the same direction as before. This can be seen when price breaks through resistance and then continues moving towards its target area.

The white marubozu may also be called an "opening gap" because it takes advantage of all of these factors:

Price did not close above its opening price level; instead, it closed below it (indicating indecision) or within 10% of where it opened at noon time on Friday (meaning there was still room for upward movement).

The open was wider than usual—typically between 20-40 points wide but at least 100 points wide during bull markets—and showed no signs of retracement back towards former levels; however, this doesn't necessarily mean that you should expect any significant movement off those levels once trading resumes next week if new support isn't found within short term timeframes

The Opening Black Marubozu

The opening black marubozu is a bearish candlestick pattern, which means it shows a sharp drop in price followed by a gap down and then a white candle that closes below the open of the first black candle. This can be interpreted as an indication that there will be further negative momentum for your stock.

The Closing White Marubozu

The closing white marubozu is a bullish candlestick pattern that forms when the close of a candlestick is above the open and the high of that candlestick. This pattern can also occur after a long run, but it doesn't need to be so long.

The closing white marubozu looks like this:

A long-bodied candle with no shadows, or doji-type candles

A body that's longer than usual (bigger than 1 minute)

The Closing Black Marubozu

A Black Marubozu is a candlestick that opens above the close of the previous day, closes below it and then gaps open again on another day. This pattern shows indecision and could be a reversal signal.

The Abandoned Baby Pattern

The Abandoned Baby pattern is a bullish reversal candlestick pattern. This candlestick consists of two candles, one large and the other small. The first candle is an extended bearish candle that closes below its opening price. The second candle opens higher than its previous high, but falls back to its opening price or lower than its previous low before rising again to new highs.

The general idea behind this pattern is that it indicates weakness in prices during the period in which they were closed at their lowest; however, after being abandoned by traders who have lost confidence in them, they start moving upward again with conviction because investors are now seeing them as having some credibility left behind after being abandoned by many others earlier on in time when prices were still declining further down into negative territory."

Doji Candlestick

A doji is a candlestick pattern that does not contain any real body, but rather only represents the opening and closing price. The name comes from the Japanese word which means “bridge” or “gateway”. Doji candles generally occur at market tops or bottoms when traders are speculating on a change in trend direction and therefore expect prices to reverse soon (or they may be acting purely defensively).

Doji patterns may also appear during sideways trading conditions when traders are waiting for a new trend to emerge before taking action again. The term "doji" has been used since medieval times as an alternative way of depicting two horizontal lines connected by another line going through them forming an inverted box shape (hence its name).

Doji reversal patterns represent indecision among investors regarding whether they should buy or sell stocks after seeing this type of pattern form; however it doesn't necessarily mean that there won't be any further movement from here - just don't expect anything too significant until after another bullish/bearish trend has formed again!

Long Legged Doji Candlestick

A long-legged doji is a candlestick with a short upper shadow and a long lower shadow. It is a bullish reversal pattern that indicates indecision by traders, who are not certain whether to buy or sell.

The appearance of this candlestick can be either good or bad for the market, depending on which direction it's pointing:

Good: This type of Doji looks like an upside correction to me. If you're looking for support then this would be your best bet in terms of finding it because if prices go down then they'll probably come back up again soon after (but not necessarily right away).

Bad: If you're trying to buy low on something then this would not be helpful because there wouldn't be enough time left until next week before prices begin rising again so unless you have very little money left over from other trades/investments then I'd say just hold onto what little cash we've got left over until next week when things start getting better again!

Dragonfly Doji Candlestick

The Dragonfly Doji Candlestick is a bullish reversal pattern. It is a bearish reversal if the real body is below the lower shadow and vice versa.

The Dragonfly Doji Candlestick has a long upper shadow and a small real body. The lower shadow should be at least twice as long as the real body, so it’s important to pay attention to both shadows when trading this pattern!

Gravestone Doji Candlestick

A Gravestone Doji is a bearish candlestick pattern that occurs on the reversal day of an upward trend. On this day, the second bar closes below the first bar with a small body, which is followed by another lower close on the third bar. This means that there has been no real movement from one bar to another and it has only been two candles that were formed within one week.

The gravestone doji can also be used for predicting future price movements as well if you know how much time should pass before your next reversal day (the fourth candle). If you see an abandoned baby pattern with long legs then this may indicate short-term bullishness in your coin market because people would rather get rid of their coins quickly than wait patiently for them to appreciate further over time!

The Evening Star Pattern

The Evening Star pattern is a bearish continuation pattern. It's a three-candlestick pattern that forms after a downtrend and looks like this:

The first candle is a long black candle that gaps down from the previous session's close. It often gets rejected, signaling an upcoming bullish reversal in price action.

The Morning Star Pattern

The Morning Star Pattern is a bullish reversal pattern and a three candlestick pattern. The first candle is a small white real body (a small white body), followed by two large black bodies. This pattern can be used to identify an uptrend or downtrend, but it works best when you see it with only three candles.

The morning star formation occurs when the price breaks through its high of the previous day, then falls back below it before closing out the day at an even lower low than yesterday's close. The third candle in this setup should have all three main components: A small white real body (small yellowish-white) near its center; an engulfing wick that looks like it's been pushed down within itself; and something dark at its bottom edge—this could be anything from just colorless shadows on top of other signals such as engulfing wicks or shadows left behind by previous candles' bottoms falling below them into their necks

The Evening Doji Star Pattern

The evening doji star pattern is a three-candlestick pattern. Here's what you'll see in each of the candlesticks:

A long red candlestick (the first)

A small white candlestick (the second), which often has an upper shadow and lower shadow that are equal in length to those on the preceding day's open or close, but not necessarily so; this can be confusing if you're looking for confirmation of a reversal.

The Morning Doji Star Pattern

A morning doji star is a candlestick pattern that appears on the chart when there's an indecision between buyers and sellers. It can also be considered to be part of a series of three candles: one long bodied candle, followed by two short ones. The first two candles are reversal patterns, which mean they indicate a trend reversal or change in the direction of price movement.

The morning doji star is considered to be more significant than its counterpart, the morning star (also known as a shooting star). The reason for this distinction lies in how these patterns form: while both forms have similar characteristics such as being small bodies with long shadows, their relative sizes differ greatly depending on whether they're done at open or close prices. For example: if you look at an open-priced doji next to its close-priced version, you'll see that while they both have tails pointing up toward zero lines on their charts—but one tail extends further than another!

Harami Cross Pattern

The Harami Cross is a two-candlestick pattern that forms in a downtrend. It is a bullish reversal signal that is formed when the second day's trading range is completely contained within the first day's range.

The Harami Cross consists of two candlesticks, which are connected at their base and top by an imaginary line called their neckline or shoulder line. When these lines cross each other like this, it indicates that there has been an increase in volume on one side of your chart as well as a decrease on another side (the downtrend). This can be used as an indicator for reversal signals because it shows you where price may be going next after being bearish for so long!

Learn all the candlestick patterns!

Candlestick charts are a great way to track the price of a stock. The candles on these charts represent the opening and closing prices for each day, along with any other information that might be useful in analyzing your investments.

Candlestick patterns can help you spot trends on the market and make informed investment decisions based on their analysis. They're also useful for determining whether or not an asset should be bought or sold at its current price point—and if so, how much could it cost you?

Conclusion

Candlestick patterns are a great way to understand the fundamentals of how stock markets work. They also help traders develop their own strategies for trading, as well as establish risk management systems and methods for measuring success. While candlesticks have many uses, they aren't perfect or infallible and can be very misleading in certain scenarios. However, the best thing about them is that they provide an excellent starting point for learning about technical analysis!

Remember to make money using our bank nifty option tips and be a part of the winning team.